Small business financing Refers to the means by which an aspiring or current business owner obtains money to start a new small business, purchases an existing small business or bring money into an existing small business to finance current or future business activity. There are many ways to finance a new and existing business, each of which features its own benefits and limitations. In the wake of the financial crisis of 2007-08, the availability of traditional types of small business financing dramatically decreased.At the same time, alternative types of small business financing have emerged. In this context, it is instructive to divide the types of small business financing into two broad categories of traditional and alternative small business financing options.

The principal advantages of borrowing funds to finance a business is that the business is generated. The disadvantages are the burdensome for businesses that are new or expanding.

· Failure to make required loan payments for risk of assets (including possibly personal assets of the business owners) that are pledged as security for the loan.

· The credit approval process may result in some aspiring or existing business ownership as a loan for the pledge of personal assets as collateral. In addition, the time required to obtain credit approval may be significant.

· Excessive debt may overwhelm the business and ultimately risks bankruptcy. For example, a business that carries a heavy debt burden may face an increased risk of failure.

Sourced from the World Bank's review, about 70% of small to medium-sized enterprises (SMEs) have difficulty in obtaining loans or credit markets. At the same time, the potential of small and medium enterprises (SMEs) is the most promising for the public and investors share owners. Among industry experts, small and medium enterprises are categorized as a world problem to be resolved. The total turnover of the SME reaches half of the gross domestic product in developing countries.

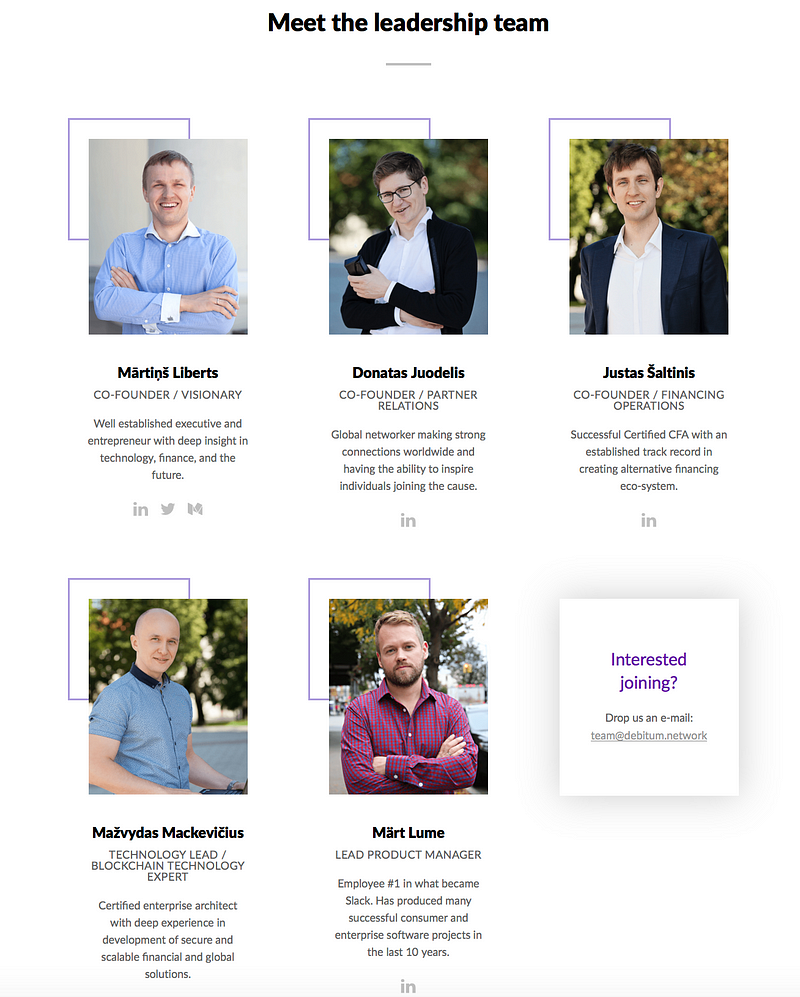

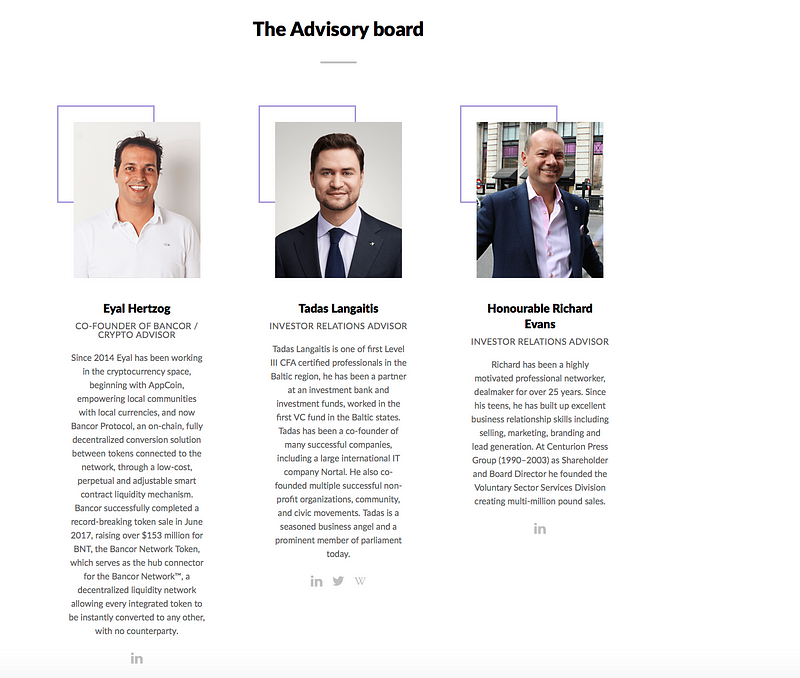

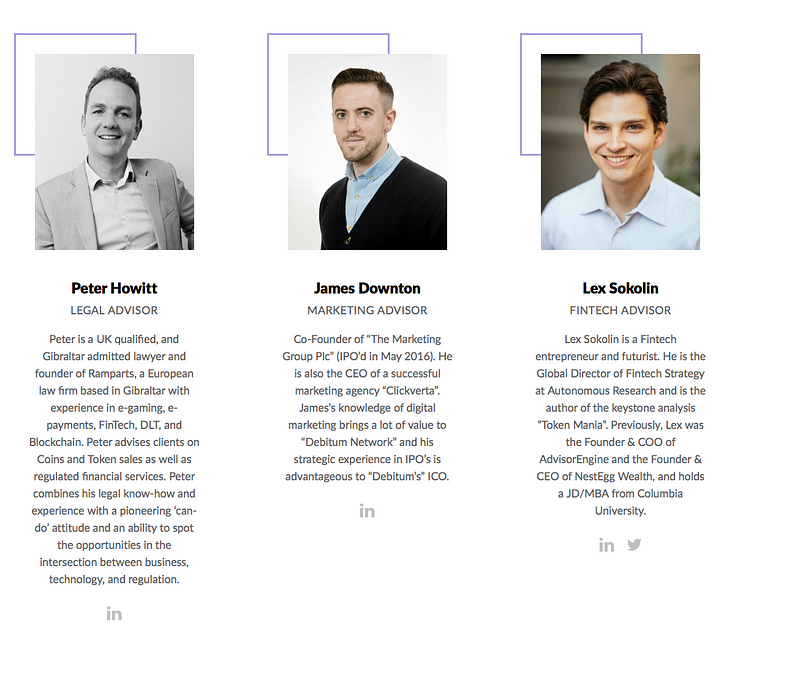

Debitum Network is designed to unite borrowers and those who help them apply: investors (lenders), risk assessors, document validators, insurers, etc.Companies or individual professionals who work in the alternative finance space can connect-in to the network for free and immediately begin facilitating cross-border deals. All actions are processed through the Ethereum Blockchain, making Debitum Network a secure and incorruptible infrastructure. It's made up of an Ethereum-based family of smart contracts, facilitated by one internal means of payment.

Transactions run through Fiat currencies, ensuring businesses can actually use the services easily in their locality, and from day one.Based on DEB token usage within their lifetime for each loan, total needed to buy DEB tokens will surpass total ability to sell DEB tokens, ie creating upward pressure on DEB token price.

How it works

TIM

Website: https://debitum.network/

Whitepaper: https: //debitum.network/whitepaper

Twitter: https: //twitter.com/DebitumNetwork

Facebook: http: //facebook.com/DebitumNetwork

Penulis : doy17

Profil : https://bitcointalk.org/index.php?action=profile;u=1701501

Eth : 0xB17500134c9cECBE14353a5ecb2d860fc840DF24

Tidak ada komentar:

Posting Komentar