As the technology develops in our global world, major changes and developments also occur in the banking and financial systems. In addition, with the tremendous spread of digital money, many regions of the world are exposed to crypto money, ranging from a series of sanotan to education and finance. But the situation is not the same in most parts of the world. The population of developing countries (Southeast Asia, Latin America and Africa) is more than 2 billion. Only Africa lives 1.2 billion people. The use of mobile phones in Africa has increased from 130 million in 2005 to 900 million by 2015. Banks are gradually beginning to make banca móvil. Within this framework, dentro de un grupo de personas en línea, conectado a un miembro de Advantages of digital a través de un juego de palabras orang keramun se puede encontrar en el sitio web, y puede ayudarlo a leer y escribir. Banco and Credit Unions, the percentage of Africans who can not benefit from prepaid banco cards and financial services fell from 95% to 60%. However, there are still many problems. Now I will introduce this solution to you, Ceyron is a revolutionary financial cryptography company. For more information about Ceyron please visit our web site Now I will introduce this solution to you, Ceyron is a revolutionary financial cryptography company. For more information about Ceyron please visit our web site Now I will introduce this solution to you, Ceyron is a revolutionary financial cryptography company.

Ceyron is invaluable because the doors of the world are open to you from the moment you win CEY. Ceyron is a change because the personal Ceyron exchange site lets you buy and sell CEY and other crypto currencies. When traveling, you can now use your Ceyron credit card because your card will always be considered a local currency card and you will get the best exchange rate among the banks. It's anonymous because everyone can run your wallet and act with the same anonymity as Bitcoin. And just like Bitcoin, you can easily transfer money whenever you want. Finally, you can send and receive international payments without any third party participation.

Ceyron Kart

Ceyron Bank Card

This card has a CHIP feature and most of it is technologically processed without contact. This is a technology product that makes your bank card much safer and harder to copy or copy. With a CHIP card, your information is safer than magnetic stripe technology and an outdated card issuer. For example, when you make a purchase with Ceyron, you will be much faster, much more reliable, and much more secure. This technology is subject to certain standards around the world and you can use your CHIP-enabled debit cards everywhere.

Non-contact is a card technology that enables quick payment of small personal purchases at the store by touching or shaking the card terminal. No PIN or signature required to make a small purchase. There is protection against accidental or multiple payments. Contactless cards are a cash substitute for small payouts.

Digipass app

DIGIPASS applications towards current technological developments and customer preferences; enabling customers to more safely verify online card transactions using their smartphones. Apps to do this can be downloaded from the official App Store and Google Play Store for all Android, iOS, and Windows smartphones; thus making online banking more secure and more convenient. such as easy to read QR code, have additional security on the device supported by fingerprint protection, no need to bring additional tools to activate online banking, no lifetime restrictions, more flexibility for PIN management and you have the opportunity to manage more accounts with the app.

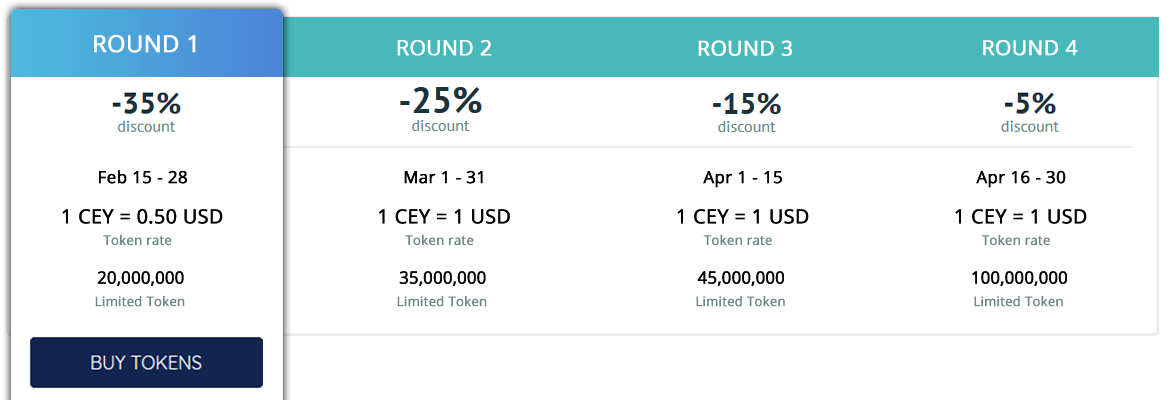

Token Sales and Distribution

Some Information;

Token Name: Ceyron

Token Icon: CEY

Price: 1.00 USD per CEE Token

Number of Tokens Sold: 250,000,000

Stock

Pre-ICO Start: 16.2.18 End of Pre-ICO: 15.3.18 Discount

Pre-ICO: 30%, 25% 15%

ICO Start: 3/16/18

Soft Cap: TBA

Hard Cap: TBA

Token Sale End: Cap Hard Moment

Accepted Approved: BTC, ETH, LTC and USD

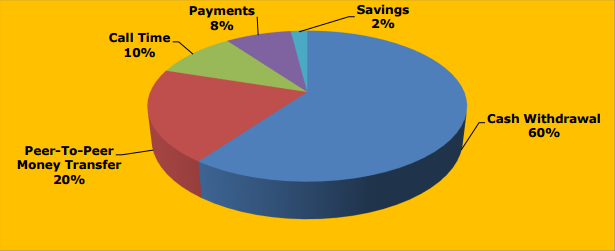

In Africa, 12% of account holders exist in the world. But the level of inclusion in the financial system is very low. The average behavior analysis of paying users resembles a general trend: withdrawals representing at least 60% of the volume of transactions; peer-to-peer transaction 20%; 10% call duration, 8% payment and 2% savings.

2011 Q1

Creating a secure loan portfolio with these funds;

Expand the plans and capabilities of the CEY Debit Card, integrate strategic partner Debit Card with CEY Debit Card, and expand the capabilities of local debate cards, including crypto wallets;

Hire integrated engineers to create crypto exchange and Bank Card features.

The launch of the CEY Debit Card Program, which CEY plans to open approximately fifteen thousand (15,000) to twenty thousand (20,000) cards worldwide.

Complete quarterly 2019 crypto exchange and add cross exchange trading capabilities, upgraded token listed on the stock exchange to other ERC20 markers, and fully integrate this exchange platform to a debit card.

Quarter 2020

To create decentralization practices to address complex banking needs, such as smart contracts, to facilitate the payment of sales tax at the sales terminals.

Team

Website: https://ceyron.io/

Technical Report: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Telegram: https://t.me/joinchat/HlFuxhLIUYQL88_NtoM4sA

Facebook: https://www.facebook.com/Ceyron/

Linkedin: https://www.linkedin.com/in/haythem96/

Twitter: https://twitter.com/cryronico

Instegram: https://www.instagram.com/cryronico/

Author : doy17

Profile : https://bitcointalk.org/index.php?action=profile;u=1701501

Eth : 0xB17500134c9cECBE14353a5ecb2d860fc840DF24

Tidak ada komentar:

Posting Komentar