The use of Artificial Intelligence (AI) for trading on cryptocurrency exchanges is a present day practice that has a quick spread around the world. AI-primarily based trading is a benefit for AI-primarily based trading platform.

AI-improved technology development is becoming more and more common in our every day lifestyles. Artificial neural networks are the premise of AI algorithms. The precept of a neural community introduction, which is pretty simple. In the system learning - artificial neural networks form a family of statistical training models, created akin organic neural networks (primary nerve systems of animals, specially - mind). In their essence those are verbal exchange structures that transmit messages to every other and have digital weight. This makes neural networks adaptable to input and capable of studying. Hence the structures based upon neural networks are constantly adapting to the converting conditions in real time want to know more details click video below ?

A wrong education or re-optimization. The marketplace is a completely open machine with the continuously changing quantitative and qualitative membership of its members. The transpiring changes effect of the market boom, its fluctuations, its volatility and price adjustments. Developers frequently try to input plenty of unconnected and unformatted entries into the AI, which is a critical mistake. A neural community skilled, for example, to recognize faces on pics, is not applicable for trade alternate - and vice versa. The trade information suggests that 80% of the money owed tied to the usage of a neural community - are set to zero within the first year after introduction.

The loss of or wrong chance management. Survival in the marketplace is at once linked to the capability to manipulate dangers. Only professional finance and chance management enable investors to survive the unusual turbulence intervals. AI, able to forecasting the marketplace adjustments with 90% accuracy, can create a series of 10 to one hundred loss making deals in collection. Even with the help of the power of degrees (the vital indicators are rate stages, not prices) - it is not possible to appropriately pinpoint how the charge modifications from the antique one (factor A on the graph ) to the new one (point B).

"This is a 360 degree solution."

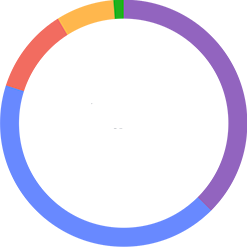

There are three target markets for this platform:

investor crypto

developers and traders and quant organizations

large miners and institutional investors

The benefits to crypto investors include high-performance crypto trading bots based on complex mathematical algorithms and models. To make it easy to operate, this platform will include mobile and web apps to manage investor bots and crypto assets.

In addition, AI-based personal financial advisers will recommend how to configure bots and rebalance the crypto portfolio. Safety is also built with automated risk management systems and easy-to-use visual bot constructors with popular trading indicators that make it ideal for investors to start making their own boots.

For developers and quantitative merchants, HyperQuant can offer professional quantitative frameworks that have many features including automating retesting on historical market data, containing hundreds of trading indicators and ready-to-use algorithms. It also has the tools to optimize the trading strategy after it is launched and includes a unified open source API protocol for all crypto exchanges.

People in this target sector will no longer need to adopt trading software for each exchange separately, as they can collect real-time market data from all major crypto exchanges and can enjoy the recurring rewards of investments depending on the use of trade bots.

For institutional players, HyperQuant provides professional hedge-fund software for asset management developed and optimized for the crypto industry. It provides access to the largest liquid-exchange liquidity through electronic communications networks.

There are effective algorithms and software for market-making and mechanisms for effective execution of large purchase / sale market orders on multiple exchanges simultaneously via hyperQuant smart routers. It is possible to use all platform features to build robo-advising dApps and trading software. In addition, it provides software and price-hedging cryptocurrency strategies for institutional investors and large miners.

"What sets HyperQuant apart from the other offerings is that, unlike many fans, we are a professional quant trader and know the in-out capital management industry," Pavchenko said.

"Speed and transaction costs are very meaningful. We built direct connections with crypto exchange, negotiated discounts on trading costs and server collocation to achieve the minimum order processing time and cost, "he said.

HyperQuant offers total transparency and compliance.

"With new crypto-related rules coming weekly, our lawyers monitor them daily and aim to make all platform features available with all rules. The investor and capital limit for each trading bot is set automatically by platform. This prevents the reduction of trading strategy performance, "he said.

Currently HyperQuant is undergoing personal token sales, funds from which will be used to further develop the platform and provide liquidity for ICO exchange and provision (ie market creation). The Company will announce its official ICO start date immediately.

Total quantity of tokens in preserve that continues the bots runnings:

Where

L - maximum bot degree

N (okay) - variety of k-degree bots at the platform for the time being

hold (k) - quantity of tokens required to keep a unmarried k-level bot running

Each buying and selling bot has several stages.

Low-fee license fee less. Each degree has its limit of capital that the bot can control.

The more capital you need to control the use of a particular bot the more tokens you have to keep.

Each bot has a total quantity of capital it may manipulate (on all levels) and a most wide variety of it customers. This mechanism protects bot owners from the dimishing of trading approach performace.

ROADMAP

TEAM SUCCESS

Site: https://hyperquant.net

Team: https://hyperquant.net/en/team/

Whitepaper: https://hyperquant.net/en/wp/

Medium: https://medium.com/hyperquant

FB: https://www.facebook.com/hyperquant.net/

YouTube: https://www.youtube.com/channel/UCOgRfmQR-GKJlbnF1tRQPgw

Twitter: https://twitter.com/HyperQuant_net

BitcoinTalk: https://bitcointalk.org/index.php?topic=2104362.0

Telegram: https://t.me/hyperquant

Author: doy17

Profile: https://bitcointalk.org/index.php?action=profile;u=1701501

Eth: 0xB17500134c9cECBE14353a5ecb2d860fc840DF24

Tidak ada komentar:

Posting Komentar